|

Entry Accounts

The Book Explorer shows a number of Entry accounts, or if none is shown,

you simply click on the Entry account node with your right mouse button to

bring up the menu, then select the "Insert..." button

to create a new

entry account. This is typically a current account, or a savings account you

have with your bank, although you can also create an Entry account without an

external account, like one which lists all your expenses etc. Click on this

icon to create a new

entry account. This is typically a current account, or a savings account you

have with your bank, although you can also create an Entry account without an

external account, like one which lists all your expenses etc. Click on this

icon

to

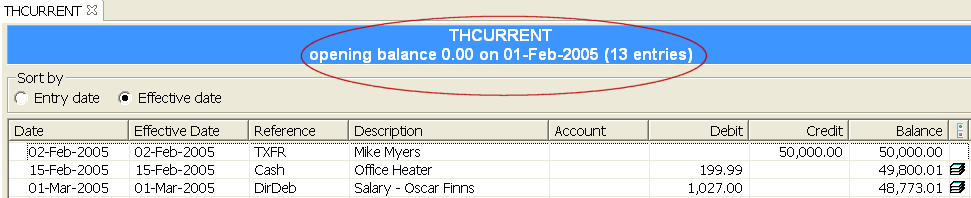

see the entry screen for an Entry account. Note that you can enter your

opening balance, and the date this balance is relevant for. It is important to

note that running balance shown in the transactions section below will take

into account this date, so you should make sure it is earlier than the first

entry in the list of transactions, unless you know for sure this is the

balance for that date from the statement of your bank account. The blue title

at the top of your transaction list will display the opening balance and the

date this balance is relevant for, as a reminder that you should take this

into account when looking at the running balances for the transactions. to

see the entry screen for an Entry account. Note that you can enter your

opening balance, and the date this balance is relevant for. It is important to

note that running balance shown in the transactions section below will take

into account this date, so you should make sure it is earlier than the first

entry in the list of transactions, unless you know for sure this is the

balance for that date from the statement of your bank account. The blue title

at the top of your transaction list will display the opening balance and the

date this balance is relevant for, as a reminder that you should take this

into account when looking at the running balances for the transactions.

Transaction Editor

You can call up the editor for the row you select be either double clicking

on it or by pressing CONTROL+E. The editor should superimpose exactly on the

fields for that entry. The following columns can be entered:

- Invoice Date: the date the entry is recorded into your account. Note that this

date is different from the transaction (effective) date, which is the date the money

actually leaves or enters your account. You should use this column to put in

the date you put in your cheque, or the date when you actually withdraw

money from your bank account, even though this is not the date shown in your

bank statement

- Transaction Date: the date in which the transaction is actually effective.

This date should be used to reconcile against your bank statement

- Reference: free format field to denote a reference, say an invoice

number, a cheque number, or other free format text of your choice

- Description: the description of the transaction. This field is used in

reports and should be used to identify the transaction visually

- Account: use this field if you are transferring the amount between your

accounts. These internal transfers can be excluded from the business reports

for reporting purposes

- Debit: put the amount into this column if the amount is a payment

- Credit: put the amount into this column if the amount is a deposit or

income

- Balance: this field is automatically calculated as the running balance

and is not editable

- Allocation popup: popup up the Allocator to specify the ledger postings

you want to make. The Allocator has a dropdown of the pre-configured

Allocation Rules you can use to send percentages of your total amount into

different ledger accounts. This facility is useful if you are entering tax

related transactions

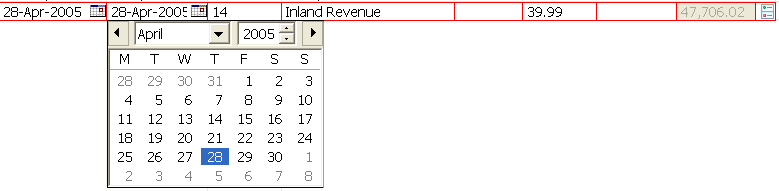

Popup Calendars can be shown for the first two date columns by clicking on

the calendar icons on the entry editor, or by using the key bindings

CONTROL+DOWN ARROW.

The Reference and Description fields have associated with them pop ups of

memorised entries which have been entered before. Also, when you tab out of

the description field, the application will attempt to fill in the amount the

the Allocations automatically from the last entry of the same description.

These features are designed to aid speedy data entry.

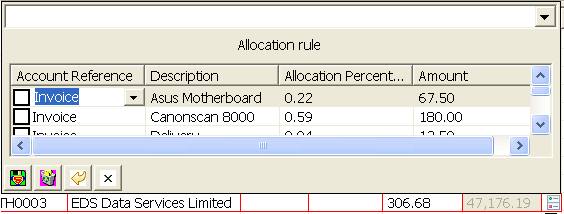

Allocator Popup

The Allocator can be brought up by either clicking on the allocation button

in the last column of the entry editor above, or you can use ALT+L key

binding. The Allocator shows a number of empty rows, each of which will

represent a percentage of your total amount, and the Ledger Account that

percentage will be debited or credited against. Built in Allocation Rules

should make it easy for you to enter tax related entries

The

first column controls the Ledger account the row will affect. Ledger accounts

do not have to be pre-created, as you can type in a new name and the ledger

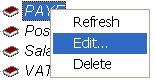

will be created automatically. However, you will have to right click on the

Ledger Account subsequently and select Edit...

in

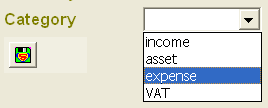

order to specify whether that Ledger Account falls into the category Income,

Expense, Asset or VAT in

order to specify whether that Ledger Account falls into the category Income,

Expense, Asset or VAT

. The

categories are used for reporting purposes. . The

categories are used for reporting purposes. |

Transcraft Home

My Accountant Home

Home

Legends

Overview

Entry Accounts

Ledger Accounts

Invoices

Reports

Scheduled Entries

Allocation Rules

Password Protection

Preferences

Year end operation

Ad hoc Reporting

Contact us

|